Simply holding cryptocurrency whether it has gained value or lost value does not mean that you owe taxes. The Cryptocurrency Tax Fairness Act introduced in Congress last year would exempt bitcoin transactions under 600 from capital gains taxation.

Cryptocurrency Tax Fairness Act 2018 - If you're looking for picture and video information linked to the keyword you have come to pay a visit to the right site. Our website gives you hints for viewing the maximum quality video and picture content, search and find more informative video content and images that match your interests. comprises one of tens of thousands of movie collections from various sources, particularly Youtube, therefore we recommend this video for you to view. This blog is for them to stop by this website.

Future Of Cryptocurrency In India And Other Countries

As of March 2018 the IRS still treats cryptocurrencies as property.

Cryptocurrency tax fairness act 2018. Update July 1 2021. HR3708 115th Congress 2017-2018 The Cryptocurrency. THE COLORADO CRYPTOCURRENCY TAX FAIRNESS ACT OF 2019.

While the act is dubbed the tax fairness act only offering exemption to investors with under 200 in gains is really stretching the idea of fair Unless a crypto investor bought the top of the crypto hype bubble. Cryptocurrency Tax Fairness Act left out of 2018 plan Further the Cryptocurrency Tax Fairness Act first introduced in September did not make it into the final plan. Introduced by Republican Rep.

David Schweikert of Arizona the Act would exempt all cryptocurrency transactions below 600 USD from IRS reporting requirements. 1 Winter 2019 Article 12 2-25-2019 HR3708 115th Congress 2017-2018 The Cryptocurrency Tax Fairness Act Rachana Khandelwal San Jose State University Follow this and additional works athttpsscholarworkssjsuedusjsumstjournal. We first reported on this possibility in late November in this update.

B Limitation. The IRS recently released new guidance stating that like-kind exchange does not apply to crypto trades at all including prior to 2018. 1 I N GENERALThe amount of gain excluded from gross income under subsection a with respect to a sale or exchange shall not exceed.

By cutting red tape and eliminating onerous reporting requirements it will allow cryptocurrencies to. And since the tax code has sweeping changes for 2018 they get to do all the research and study again to figure out what best suits your tax situation next year. IN THE HOUSE OF REPRESENTATIVES.

Iss1 Article 12. Financial stability and fairness Jon Danielsson 09 November 2018 This column argues that if private cryptocurrencies were to find widespread economic use either coexisting with or fully displacing fiat money the result would be increased financial instability inequality and. Be it enacted by the General Assembly of the State of Colorado SECTION 1.

But the bottom line is doing your part by reading columns like this saves your tax professional from spending time educating you on the basics and saving their time means you get to keep more of your crypto gains for yourself. Khandelwal Rachana 2019 HR3708 115th Congress 2017-2018 The Cryptocurrency Tax Fairness Act The Contemporary Tax Journal. Cryptocurrency Tax Fairness Act CTFA introduced in US.

The IRS has definitively stated that like-kind exchange does not apply to crypto for tax years 2018 onward. Gain from sale or exchange of virtual currency. As Ive said ever since the IRS issued their woefully inadequate and ill-conceived initial guidance on the taxation of cryptocurrencies the biggest problem with the current policy is that every single transaction generates a capital gain or capital loss for tax purposes.

To amend the Internal Revenue Code of 1986 to exclude from gross income de minimus gains from certain sales or exchanges of virtual currency and for other purposes. A In general Gross income shall not include gain from the sale or exchange of virtual currency for other than cash or cash equivalents. But Congress 2017 tax bill signed by President Trump effectively kills the Cryptocurrency Tax Fairness Act.

A BILL To amend the Colorado Income Tax Act of 1987 to exclude from gross income de minimis gains from certain sales or exchanges of virtual currency and for other purposes. According to the bill anyone with gains under 200 in a tax year wont have to report anything cryptocurrency related to their tax returns. Last September the Cryptocurrency Tax Fairness Act was introduced as a way to create a taxing structure for purchases made with cryptocurrency and would allow customers to make purchases up to 600 without burdensome reporting requirements.

The Contemporary Tax Journal Volume 8 Issue 1The Contemporary Tax Journal Volume 8 No. The second amendment deals with the Cryptocurrency Tax Fairness Act. The CTFA called for transactions.

The high-risk bet of saving money on taxes by failing or refusing to report crypto gains is not likely to pay off in the long run compared to the trillions at stake in market capitalization as crypto is increasingly recognized more and more as a legitimate investment. In order to owe taxes you would have to sell cryptocurrency trade for another cryptocurrency or purchase something with it. Recently the USA also came up with The Virtual Currency Tax Fairness Act of 2020.

These are known as taxable events. Cryptocurrency Tax Fairness Act H. This means bitcoin users would only have to calculate the tax implications of their bitcoin payments if theyre in amounts greater than 600.

Its consideration as a legal tender was dismissed but its federal nature varies from state to state. Anyone with gains under 200 in a tax year wont have to report anything cryptocurrency related on their tax returns.

Japan 2018 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Japan In Imf Staff Country Reports Volume 2018 Issue 333 2018

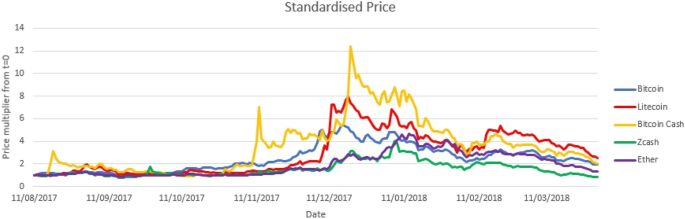

Pdf Challenging Practical Features Of Bitcoin By The Main Altcoins

Pdf Challenging Practical Features Of Bitcoin By The Main Altcoins

Pdf Challenging Practical Features Of Bitcoin By The Main Altcoins

Pdf Challenging Practical Features Of Bitcoin By The Main Altcoins

Dyskusja Na Temat Kursu Btc Dla Poczatkujacych 2018 Strona 1954 Polskie Forum Bitcoin Bitcoin Crypto Bitcoin Blockchain

Https Pusdiklat Apuppt Ppatk Go Id Be Assets Images Publikasi News1611710896 Pdf

Japan 2018 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Japan In Imf Staff Country Reports Volume 2018 Issue 333 2018

Challenging Practical Features Of Bitcoin By The Main Altcoins Springerlink