However if household income exceeds 479000 for married couples or 425800 for individuals then the rate of capital gains tax is 20. The actual percentage that you pay in taxes on your crypto capital gains depends on the income tax bracket you fall under as well as the marginal tax rate.

Uk Capital Gains Tax Cryptocurrency - If you're looking for video and picture information linked to the keyword you've come to pay a visit to the right blog. Our site provides you with hints for viewing the highest quality video and image content, search and locate more informative video content and images that fit your interests. includes one of tens of thousands of video collections from several sources, particularly Youtube, so we recommend this video for you to view. You can also bring about supporting this website by sharing videos and images that you enjoy on this blog on your social networking accounts such as Facebook and Instagram or educate your closest friends share your experiences about the simplicity of access to downloads and the information you get on this website. This site is for them to visit this site.

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

The rate of capital gains tax is typically 15 on profits.

Uk capital gains tax cryptocurrency. The main taxes that apply to cryptocurrency gains or losses in the UK are Capital Gains Tax CGT and Income Tax. There are various methods of acquiring cryptocurrency that might make you liable to be taxed. Capital gains tax CGT is a tax that may be charged on the profit or gain made when selling gifting transferring exchanging or disposing of an assets.

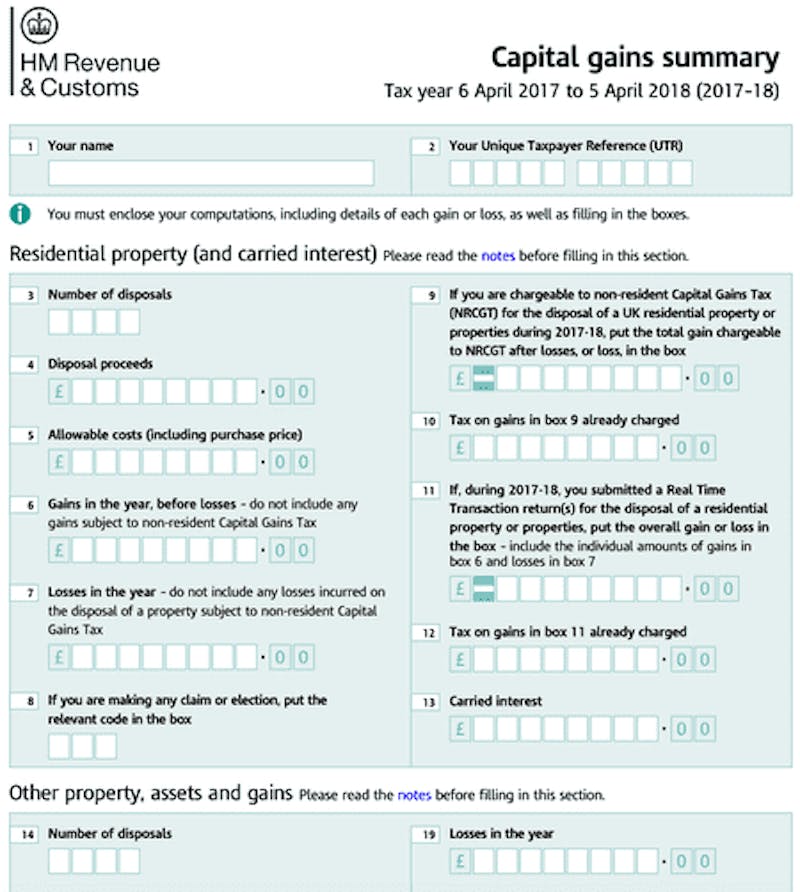

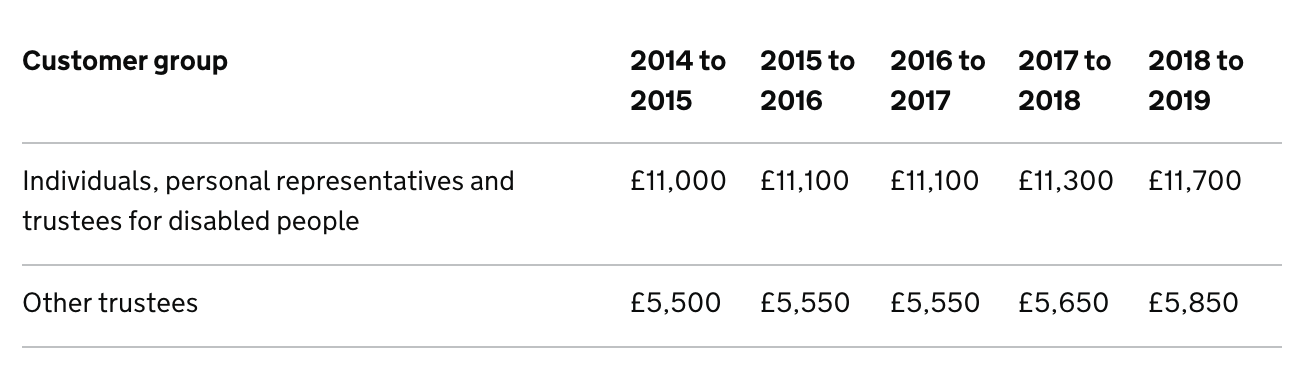

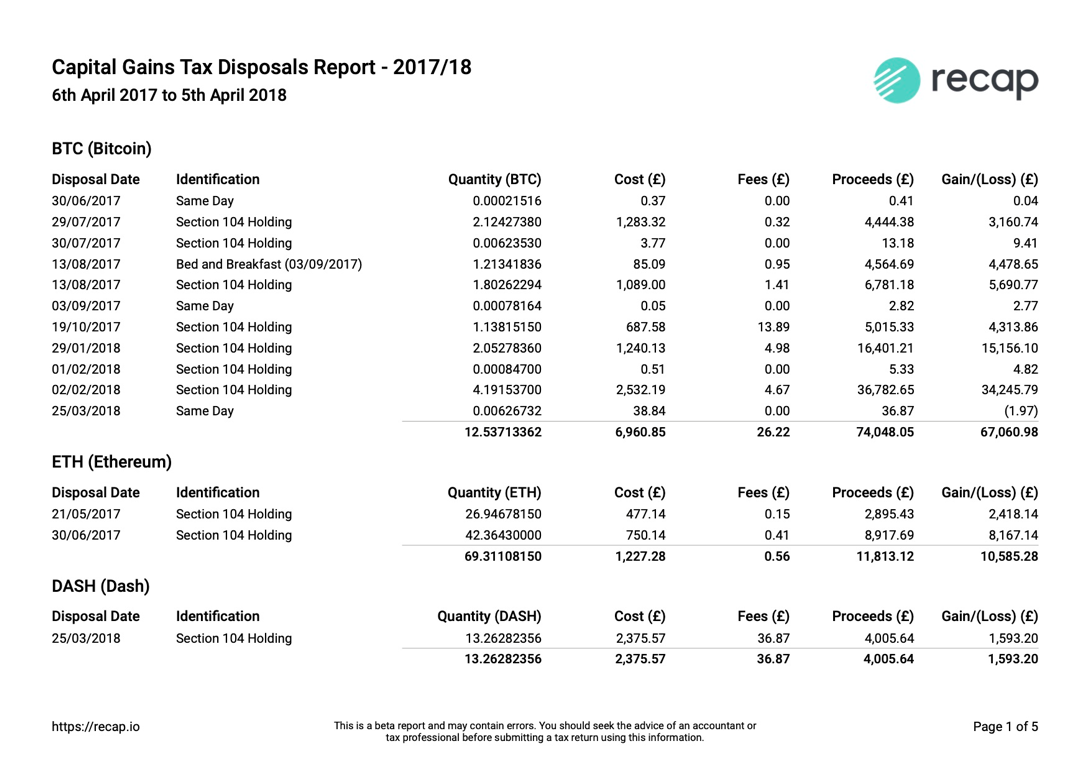

You may offset your annual Capital Gains Tax CGT exemption if it is unused elsewhere. You pay Capital Gains Tax when your gains from selling certain assets go. To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales.

In broad terms a UK resident making a capital gain made on the disposal of cryptocurrency is taxed at 10 up to the basic rate of tax 37700 to the. Do I have to be a crypto trader to be taxed. Typically if you held cryptocurrencies for less than a year gains are taxed at.

Most people that have bought or traded any cryptocurrency chose to use a cryptocurrency tax solution to automate the process of calculating and reporting their capital gains. You should still keep records of these transactions so that you can deduct the costs when you eventually sell them. In the UK you have to pay tax on profits over 12300.

6 ways to minimise CGT on Cryptocurrency. Changes to the annual exempt amount for Capital Gains Tax for the tax. See How are Bitcoin cryptocurrencies or cryptoassets taxed in the UK.

BTC GBP Any sale of cryptocurrency is subject to Capital Gains. In this guide we break down everything you need to know when it comes to cryptocurrency taxes for UK citizens. In almost all cases individuals holding cryptoassets are subject to Capital Gains Tax CGT.

As such Capital Gains Tax is the primary form of taxation on cryptocurrencies in the UK which is paid at the time of disposal of the asset. You may also be liable to pay Income Tax and National Insurance Contributions NICs if you receive cryptocurrencies from your employer as a type of payment or if you participate in mining or receive cryptocurrency via airdrops. Taxes can be a complicated subject.

Coinpanda is one of very few crypto tax solutions that have full support for UK Share Pooling Share Identification rules. Which taxes apply to cryptocurrencies in the UK. There is also a threshold of 20 for higher-rate taxpayers that earn over 50000.

You should obtain tax relief on the direct costs of buying and selling the cryptocurrency investment. Capital Gains Tax CGT HMRC classifies digital currency as an asset much like a house or a share in a company which means that you need to assess your capital gains every time you sell trade or give away your crypto. If your annual taxable income is greater than 150000 you will pay a higher percentage tax rate than someone who is making just 45000 annually.

Whether receiving cryptoassets as airdrops from mining as transaction confirmation or from employers all such tokens are hit by CGT in addition to National Insurance contributions. Check if you need to pay tax when you receive cryptoassets. There are no taxes on buying crypto in the UK or even hodling it for as long as you want.

When you dispose of cryptoasset exchange tokens known as cryptocurrency you may need to pay Capital Gains Tax. For the large majority of cryptocurrency users CGT is the applicable tax. We go into all the different types of capital gains.

Currently taxpayers are only liable for capital gains tax on any gains above 12300 and there is a capital gains tax at 10 for basic-rate taxpayers those in the UK that earn up to 50000 in annual income. There are a number of assets such as your home and any personal belongings worth less than 6000 that are exempt from CGT. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC.

So if the profit from selling your cryptocurrency in addition to any other asset gains is. Under the UK crypto tax rules this income is considered capital gains and is accordingly subject to capital gains taxes. And so irrespective of your view on the validity of cryptocurrency you will always be liable to pay tax on your investment profits from them.

This tax solution has in a short time become very popular in the UK and is today used by several thousand individuals to make it simple to calculate and report their crypto taxes. If your gains on disposal are taxed as capital section 104 TCGA pooling will apply. The annual tax-free allowance for an individuals asset gains is 11300 for 201718.

Uk Cryptocurrency Tax Guide Cointracker

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

Uk Cryptocurrency Tax Guide Cointracker

Uk Gov T Unveils Cryptocurrency Tax Guidelines For Individuals Business Telegraph

Best Bitcoin Tax Calculator In The Uk 2021

Cryptocurrency Taxation In The United Kingdom By Chandan Lodha Cointracker Medium

How Cryptocurrency Is Taxed In The United Kingdom Tokentax

Cryptocurrency Taxes In The Uk The 2020 Guide Koinly

Uk Cryptocurrency Tax Guide Cointracker