The ramifications are two-fold. Some emerging markets and developing countries have a large share of their money supply in FX today.

What Are The Effects Of Cryptocurrency On Government Monetary Policy - If you're searching for video and picture information linked to the key word you have come to pay a visit to the ideal blog. Our website gives you suggestions for viewing the maximum quality video and image content, search and find more informative video articles and graphics that match your interests. comprises one of thousands of video collections from various sources, particularly Youtube, so we recommend this video for you to see. You can also bring about supporting this site by sharing videos and images that you enjoy on this site on your social media accounts like Facebook and Instagram or educate your closest friends share your experiences about the simplicity of access to downloads and the information you get on this website. This blog is for them to visit this website.

Pin On Ohno Wtf Crypto

The Federal Reserve attempts to limit inflation through monetary policy by adjusting the federal funds rate upwards which in turn affects interest rates lenders charge consumers.

What are the effects of cryptocurrency on government monetary policy. The world economy will change and currencies will go into electronic savings. Thus the risk for cryptocurrencies is that the state does not conduct an independent interest rate policy. Monetary Policy in the Digital Age.

By signing up youll get thousands of. They use central banks to issue or destroy money out of thin air using what is known as monetary policy to exert economic influence. This column investigates whether they can jeopardise the primary function of central banks namely controlling inflation and economic activity.

Del Castillo M 2019 Alibaba Tencent five others to receive first Chinese cryptocurrency Forbes 27 August. Responsible central bankers should therefore welcome the flourishing of cryptocurrencies as a way to bind their institutions to the mast of prudent monetary policy. The government is trying to exercise different economic policies which are influencing UK business organizations to gain better living standard and improve the growth for the sake of the country.

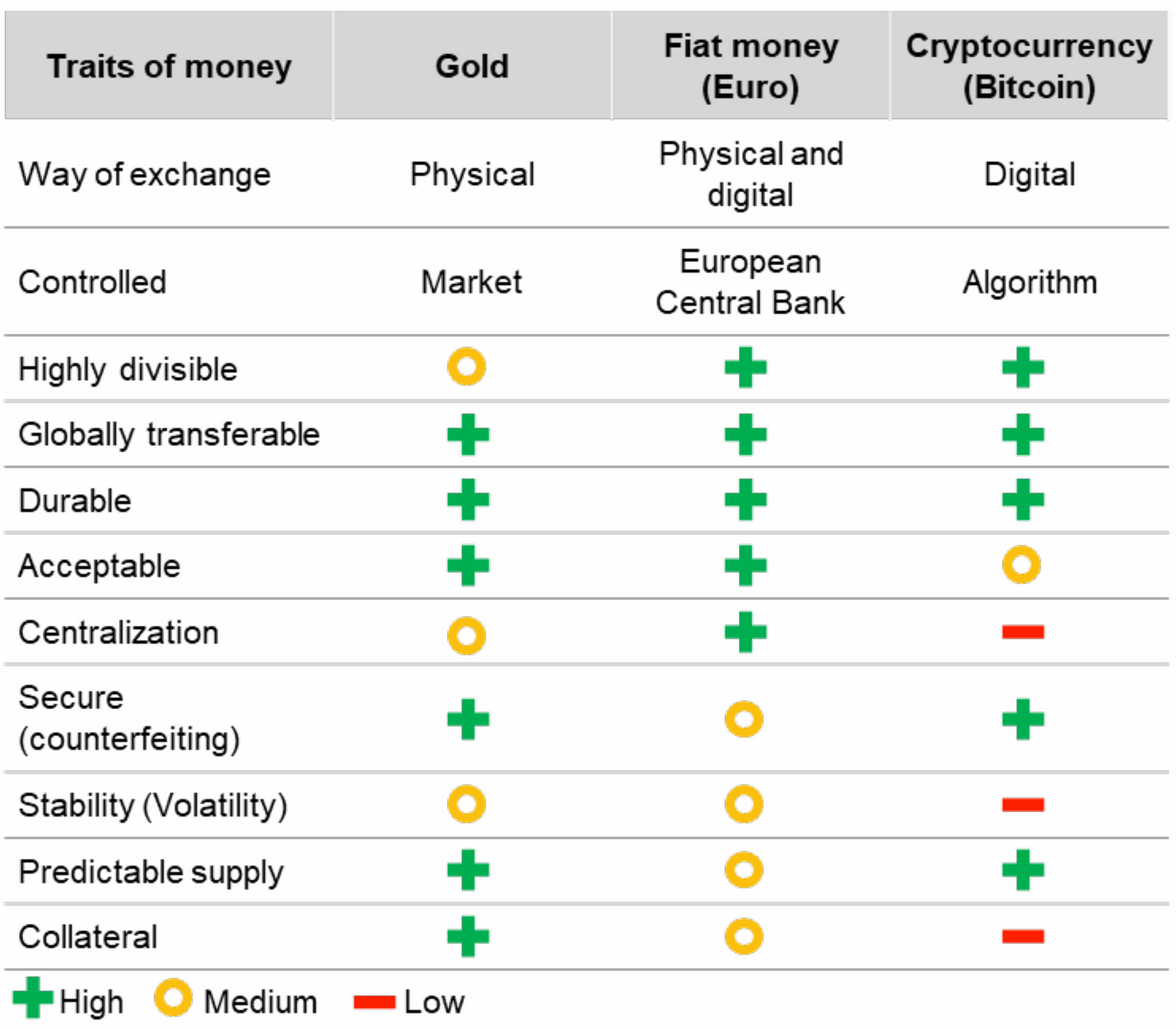

Cryptocurrencies are robust to over-issuing the double-spending problem -ie the holder of the currency should not be able to spend the same token twice- and counterfeiting see Narayanan et al 2016 for details3 These cryptocurrencies are different from the notes issued by financial. If banks lose big in the capital markets the tax payers would bail them out and protect consumer savings with FDIC insurance. The column argues that even if this system could maintain price stability in an economy the market would not provide the socially optimum amount of money.

The number of investors is growing every day and as a result electronic assets will be valued much more than they are now. By choosing a specific type of monetary policy they can prevent cryptocurrencies from being valued as a medium of exchange but they could still be valued for other reasons for instance as. They also dictate how fiat currencies can be transferred.

What are the effects of cryptocurrency on the South African government monetary policy. For Teachers for Schools for Working Scholars for. Cryptocurrencies have attracted the attention of consumers policymakers and the media.

This by itself could create risks to the effectiveness of monetary policy to financial stability and ultimately to growth. Protections for consumers who use these currencies. Monetary policy therefore has an effect on short-term interest rates.

1 Future of money. There was no incentive for these banks to rein in risky lending. Such skepticism fueled the creation of Bitcoin.

But in the future large cryptocurrency holdings could complication monetary policy management. The Functions of. As a result monetary policy reflects a balancing act of moderation with the Fed trying to.

The existence of cryptocurrencies as an alternative safe haven during times of financial crisis may prompt central banks to behave in a more responsible way than they otherwise would. Restricts discretionary monetary policy. Second the central banks have the advantage.

Where this report examines the regulation of cryptocurrencies it generally focuses on how they. Cryptocurrencies potential role in facilitating criminal activity and concerns about protections for consumers who use these currencies. THE EFFECTS OF CRYPTOCURRENCIES ON THE BANKING INDUSTRY AND MONETARY POLICY to perform both functions too big to fail was born Sorkin A.

Monetary policy is a set of actions through which the monetary authority determines the conditions under which it supplies the money that circulates in the economy. First the coexistence of government money and cryptocurrencies that are valued as mediums of exchange is not a theoretical impossibility. A government could still however maximise social.

Finally the report analyzes cryptocurrencies impact on monetary policy. How Government Spending Fiscal and Monetary Policy Impact on Business. By cryptocurrencies when they are used as money and related policy issues focusing in particular on two issues.

Currency competition can succeed in calming inflation and preventing the sort of manipulation of interest rates and. European Department International Monetary Fund 17 Potential impact on monetary policy. Carney M 2019b The growing challenges for monetary policy in the current monetary and financial system speech by the Governor of the Bank of England Jackson Hole Symposium 23 August.

If the share of payments made by cryptocurrencies increases government-issued money will face market competition from private issuers. Crypto assets may one day reduce demand for central bank money. The global financial crisis and the bailouts of major financial institutions renewed skepticism in some quarters about central banks monopoly on the issuance of currency.

Identify the Impact of Government Spending On Business. Nevertheless the risks of cryptocurrencies becoming serious contenders remain small as long as fiat currencies issued by the worlds major central banks continue to deliver effectively the three traditional functions of money. Finally the report analyzes cryptocurrencies impact on monetary policy and the possibility that central banks could issue their own government-backed digital currencies.

Infocus The Pros And Cons Of Cryptocurrency Investment Efg Asset Management

Due To Security And Government Regulations Concerning Money Laundering There Is A Short Account Verificatio Bitcoin Bitcoin Transaction Bitcoin Mining Software

Bitcoin Is A Global Solution To The Divided Problems Bitcoin Global San Francisco Blog

Pin On Cryptocurrency News

The Impact Of Crypto Currencies On Developing Countries By Philipp Sandner Medium

Pin On Bitcointe Com

Fair Prices For Btc Buys From Online Exchange Provider Switchere Read Here Http Bit Ly 33mbljp Social Media Network Service Bank Card

How The Xrp Tree Project Is Reducing The Environmental Impact Of Ripple Technology Cryptocurrency Environmental Impact Ripple

Cryptocurrencies And Monetary Policy Bruegel